D.C. region’s housing market is stuck in the doldrums

Via:The Washington Post written by: Kathy Orton

Lackluster. Lethargic. Stagnant. Pick your favorite adjective. All of them have been used to describe the recent state of the D.C. region’s housing market.

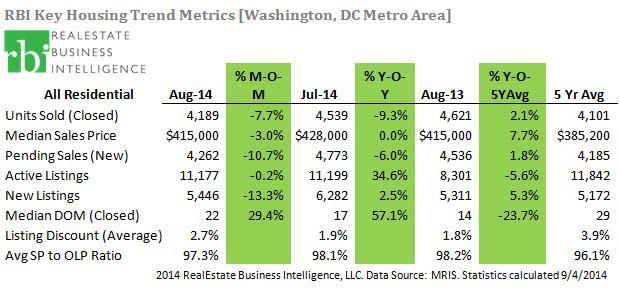

A report released Wednesday by RealEstate Business Intelligence, a subsidiary of MRIS, showed that sales and pending sales were down again last month. The median price was flat. The number of homes on the market declined for the first time in 10 months, and those listings took longer to sell — all signs that indicate the recovery remains stubbornly stuck in neutral.

Buyers are showing no eagerness to jump into the market despite mortgage rates floating along at yearly lows for the past couple of months. Tougher mortgage standards have kept some first-time buyers out of the market. Uncertainty about the economy has other buyers leery of making large purchases. And those home buyers who refinanced at historic low rates are reluctant to move.

There were 432 fewer sales last month compared with August 2013, a 9.3 percent decrease. It was the 10th month in the past 11 that year-over-year sales have declined. Sales volume this year is down almost 8 percent compared with the first eight months of last year, with 2,515 fewer sales than through August 2013.

Pending sales – homes that are under contract but the deals have not closed – fell by 274, a 6 percent decrease. It was the ninth month in a row of year-over-year declines.

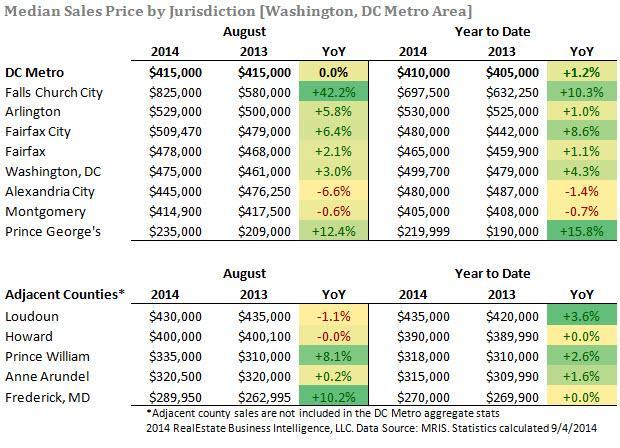

The median price for a home in the D.C. region held steady at $415,000 last month, unchanged from August 2013. Falls Church City made a huge leap in median price, up to $825,000 from $580,000, but the 42.2 percent increase was due to the limited sample size of 15 sales that skewed the number. Prince George’s County continues to show strong price growth. Its median price rose to $235,000 from $209,000. Meanwhile, Alexandria’s median price fell to $445,000 from $476,250.

Inventory, which had been growing slowly but steadily, took a step back in August. The number of homes for sale last month — 11,177 — was down slightly from July but up significantly from August 2013, an increase of 2,876 homes, or 34.6 percent. It was the highest inventory level for August since 2011.

In most cases, homes are lingering longer on the market these days. Half of the homes sold last month took 22 or more days to sell, nearly a week longer than a year ago.