MORTGAGE RATES HOLD STEADY

As featured in The Washington Post

A government shutdown was averted. The Federal Reserve stood pat on interest rates. The two events expected to rock the mortgage market never came to fruition. As a result, home loan rates barely budged this week, according to the latest data released Thursday by Freddie Mac.

A government shutdown was averted. The Federal Reserve stood pat on interest rates. The two events expected to rock the mortgage market never came to fruition. As a result, home loan rates barely budged this week, according to the latest data released Thursday by Freddie Mac.

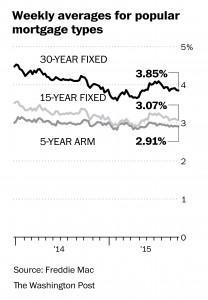

The 30-year fixed-rate average ticked down to 3.85 percent with an average 0.6 point. (Points are fees paid to a lender equal to 1 percent of the loan amount.) It was 3.86 percent a week ago and 4.19 percent a year ago. The 30-year fixed-rate average has stayed below 4 percent for the past 10 weeks.

The 15-year fixed-rate average slipped to 3.07 percent with an average 0.7 point. It was 3.08 percent a week ago and 3.36 percent a year ago.

Hybrid adjustable rate mortgages were flat. The five-year ARM average was unchanged from last week at 2.91 percent with an average 0.4 point. It was 3.06 percent a year ago.

The one-year ARM average also was the same as a week ago, holding steady at 2.53 percent with an average 0.2 point.

“In contrast to the volatility in equity markets, the 10-year Treasury rate — a key driver of mortgage rates — varied just a little more than 10 basis points over the last week,” Sean Becketti, Freddie Mac chief economist, said in a statement.

“Despite persistently low mortgage rates, the pending home sales index dropped 1.4 percent in August, suggesting possible tempering in existing home sales in September.”

Meanwhile, mortgage applications tumbled this week, according to the latest data from the Mortgage Bankers Association.

The market composite index — a measure of total loan application volume – dropped 6.7 percent from the previous week. The refinance index fell 8 percent, while the purchase index decreased 6 percent.

The refinance share of mortgage activity accounted for 58 percent of all applications.